How WhatsApp Banking is Revolutionizing the Banking Sector

With over 2 billion active users, WhatsApp's popularity has soared in recent years. So it comes as no surprise that it is now making its way into the banking sector by SME financial institutions.

WhatsApp has revolutionized the way people communicate globally, and it is no surprise that it is now making its way into the banking sector. With over 2 billion active users, WhatsApp has become a key tool for SME financial institutions to engage with customers and offer banking services through the app. With the ability to complete transactions, check account balances, and get customer support, WhatsApp banking has gained immense popularity, thanks to conversational banking and the use of chatbots. This article delves deeper into the benefits of WhatsApp banking and how it can help financial institutions enhance their customer experience.

Chatbot and Conversational Banking:

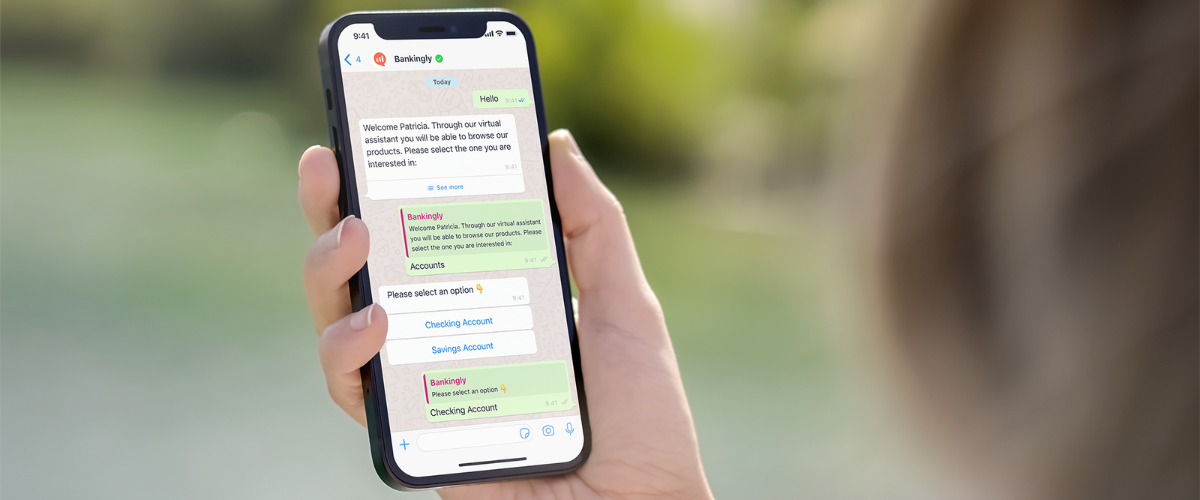

Conversational banking is an innovative approach to customer service that is gaining popularity in the financial services industry. It involves using chatbots powered by artificial intelligence (AI) to provide personalized and efficient service to customers. With the help of Bankingly, a leading provider of conversational banking solutions, financial institutions can now seamlessly integrate chatbots into their customer service strategy.

This allows banks to provide 24/7 customer support, complete transactions through WhatsApp, and tailor their responses to meet the specific needs of their customers. Conversational banking has transformed the customer experience, making it more efficient, cost-effective, and convenient. It's a rapidly growing trend that helps banks stay ahead of the competition while increasing customer satisfaction. By leveraging the power of WhatsApp, banks can reach a wider audience and provide a more accessible and convenient way to manage their finances.

Benefits of WhatsApp Banking:

WhatsApp banking offers numerous benefits for both customers and SME Financial Institutions.

For customers, it provides a convenient and accessible way to access banking services without visiting a bank branch or having to call or wait on hold during a phone call. Customers can complete transactions, check their account balances, and get customer support from their bank, all through WhatsApp, at any time.

For SME Financial Institutions, WhatsApp banking can be more cost-effective than traditional banking services, resulting in a more efficient and streamlined customer service experience. WhatsApp banking allows banks to automate repetitive FAQs and processes, freeing up staff to focus on more complex tasks and providing a faster response time to customer inquiries.

How can it help SME financial institutions?

SME financial institutions can benefit greatly from conversational banking solutions like Bankingly. These solutions allow banks to provide tailored services that meet the unique needs of their customers, improving customer satisfaction and loyalty.

Conversational banking also reduces costs by providing self-service options that allow customers to manage routine tasks such as checking account balances, making transfers, and updating their information.

In addition to this, chatbots provide insightful data that can be used to better understand customers' banking habits, behavior, and preferences. This data can be used to develop new products and services that meet customer needs, improving overall profitability. By collecting and analyzing customer data, banks can also eliminate bottlenecks in their processes and improve customer satisfaction scores.

Conclusion:

In summary, WhatsApp banking is a game changer for the financial services industry, offering numerous benefits for both customers and financial institutions. By leveraging the power of conversational banking solutions provided by companies like Bankingly, SME financial institutions can easily integrate WhatsApp banking into their customer service strategy, providing a personalized and efficient experience to their customers. This can lead to increased customer satisfaction, higher efficiency, and reduced operational costs.

If you're an SME financial institution looking to stay ahead of the curve, WhatsApp banking is definitely an option worth exploring. To learn more about how to implement conversational banking solutions and enhance your customer service strategy, don't hesitate to get in touch with us!

Back

Backto top