Our Solutions

We provide financial institutions with a modern and integrated digital banking suite within weeks.

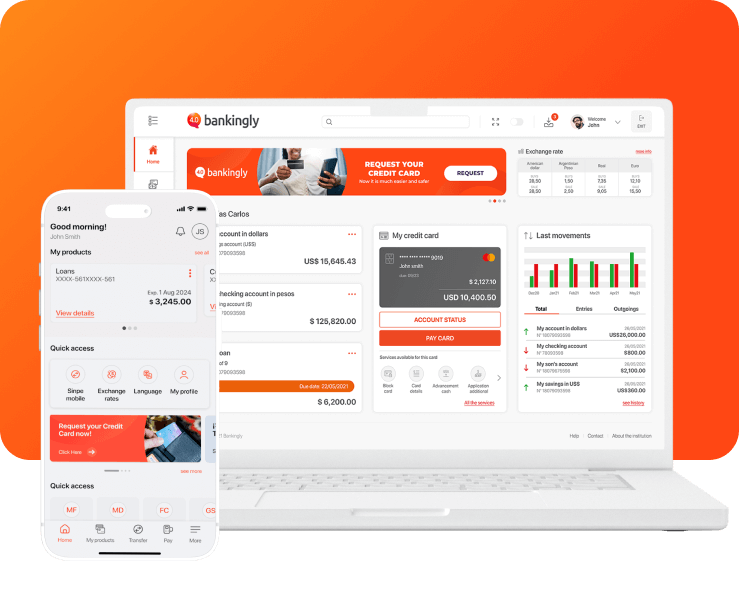

Web & mobile banking

Ensure the relevance and permanence of your financial institution, increasing revenues and optimizing operational costs.

Our SaaS digital banking solution is a cloud base platform that allows you to digitize your financial services through a rapid implementation process in a way that will save you costs related to infrastructure, personnel, and technical support.

A world class solution, with a pricing model based on the number of monthly active users in compliance with the highest international security standards.

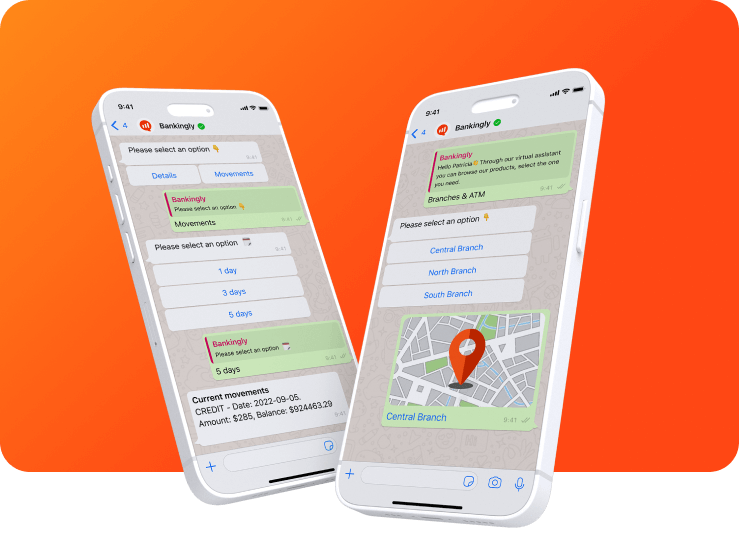

Conversational banking

Secure a personalized and friendly experiences on digital channels for your customers.

- Improved customer service and company image.

- Low-cost launch.

- Quick implementation: product already available and integrated.

- New communication channel to your clients.

- Increases transactions and retains customers.

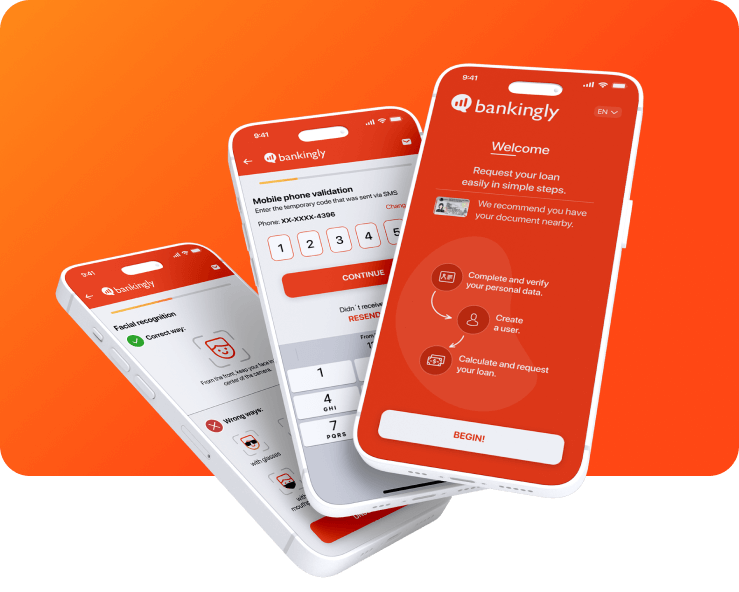

Digital onboarding & loan origination

Manage credit applications and loans granted from a single platform, covering the entire loan lifecycle.Connection with external databases (goverment sources, credit bureaus and identity data providers)

- Oversee user authentication processes by valuing unique facial features.

- Empower management efficiency: from origination to collections.

- Reduction of processing times.

- Scalability in terms of infrastructure and personnel

- Prevention of money laundering

- Real-time information.

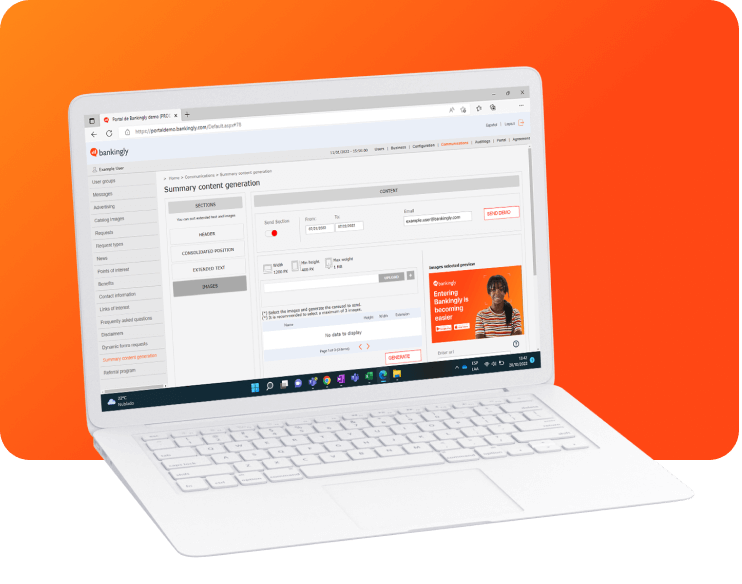

Admin portal

Incredible digital channels require a dynamic management platform.

An intuitive & easy to use Administration Portal in which you can:

- Customize your digital channels according to your current functionalities

- Detect real-time incidents which allow immediate decision-making and a better response to customers.

- Empower an effective communication through segmented campaigns according to customers' profiles and/or behaviors in relation to the web and app channels

- Improve debt collection rates and reactivation of inactive users through messages via mail, within the same channels, or even through push messages.

- Configure and customize the different security devices according to your policies and local regulations.

- Provide better user support through the Administration Portal developed to see the detailed traceability of customer journey.

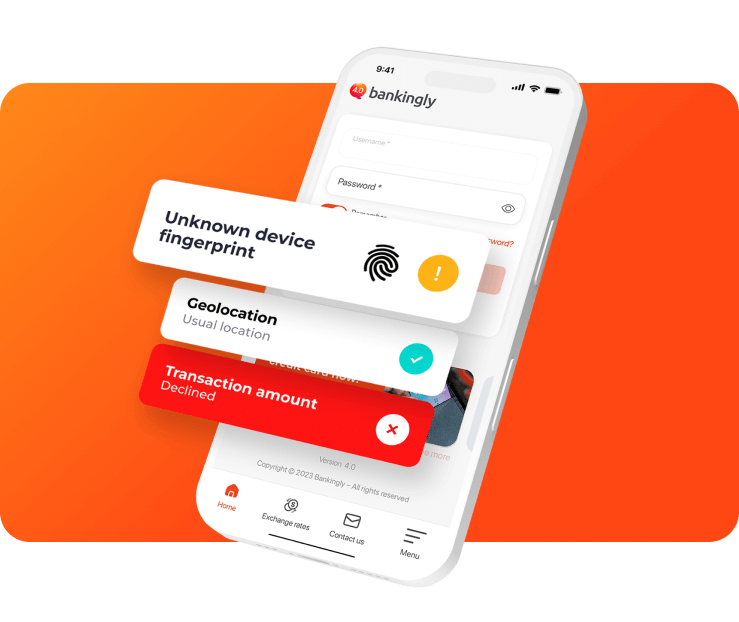

Fraud prevention

Detect and prevent cyber-attacks against your customers, protecting your institution from financial loss and reputational issues.

Through machine learning and based on predictive analysis, we identify patterns related with high-risks behaviors. We analyze the conducts of your users and design intelligent profiles that raise red flags when a transaction is generated outside the usual parameters.

- Reduction of transactional fraud through real-time analysis of user-generated transactions.

- Immediate actions execution based on rules predefined by your financial institution.

- Automatic detection of anomalies based on user behavior.