Back to all solutions

Back to all solutions

Digital onboarding & loan origination

Get your customers to apply for new finance products, efficiently and securely.

The easy integration with internet banking will attract new customers and increase conversion rates. It offers cross-selling opportunities, improves operational efficiencies and deflates fraudulent activities.

Enhance customer interactions

Boost business and decrease cycle times for the highest return on origination investments

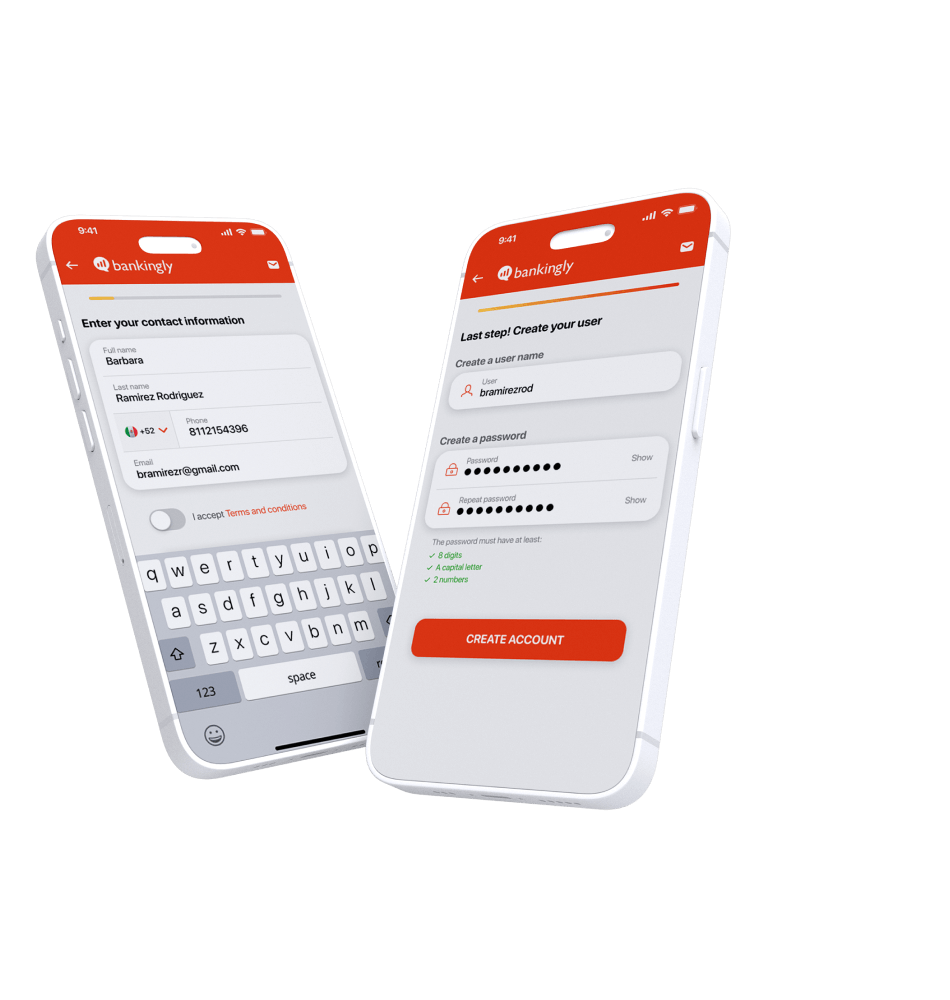

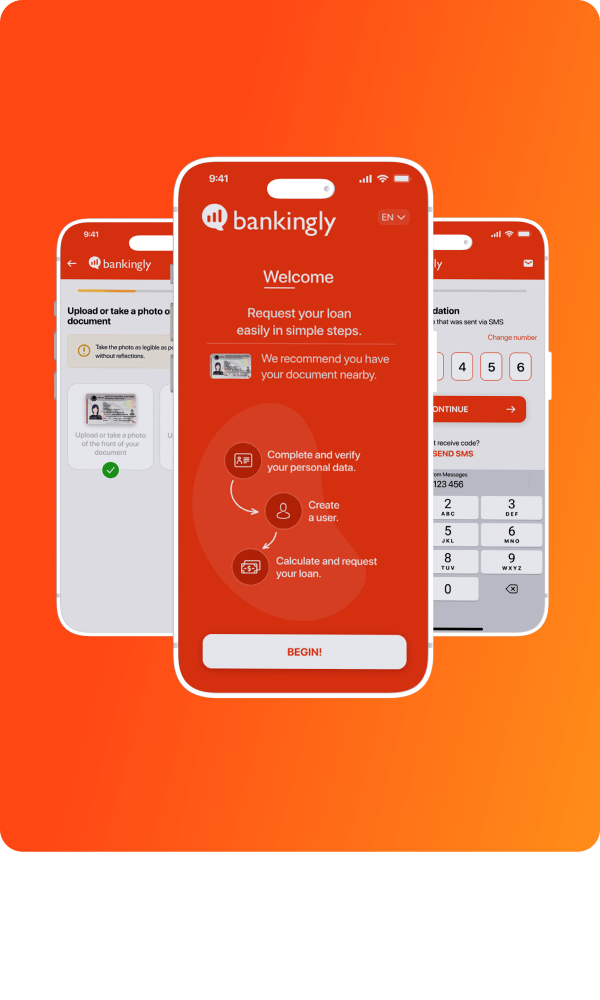

Fast-track customer onboarding

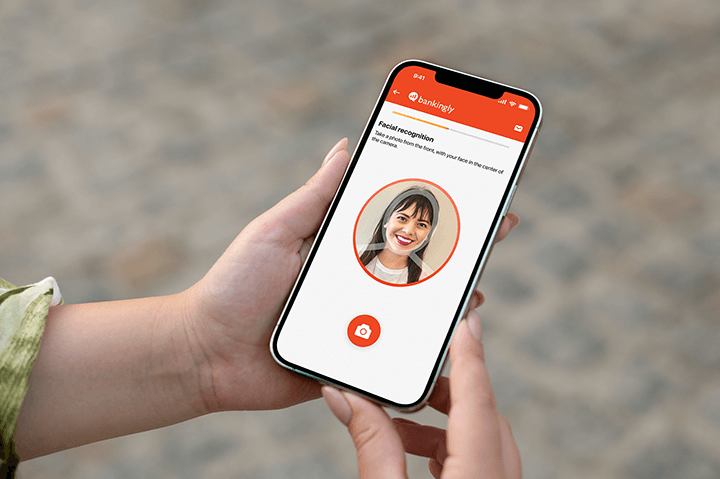

- User information validation with legal ID processing, photo/OCR capture, biometrics, proof of life, photo validation, anti-money laundering checks, international list validation, and custom list option.

- High-converting design for optimized customer experience.

- Personalized flow to cater to each customer's unique needs.

- Detailed progress tracking and conversion metrics for actionable insights.

- Seamless integration with third-party services through modular design.

- Adherence to market regulations for legal compliance.

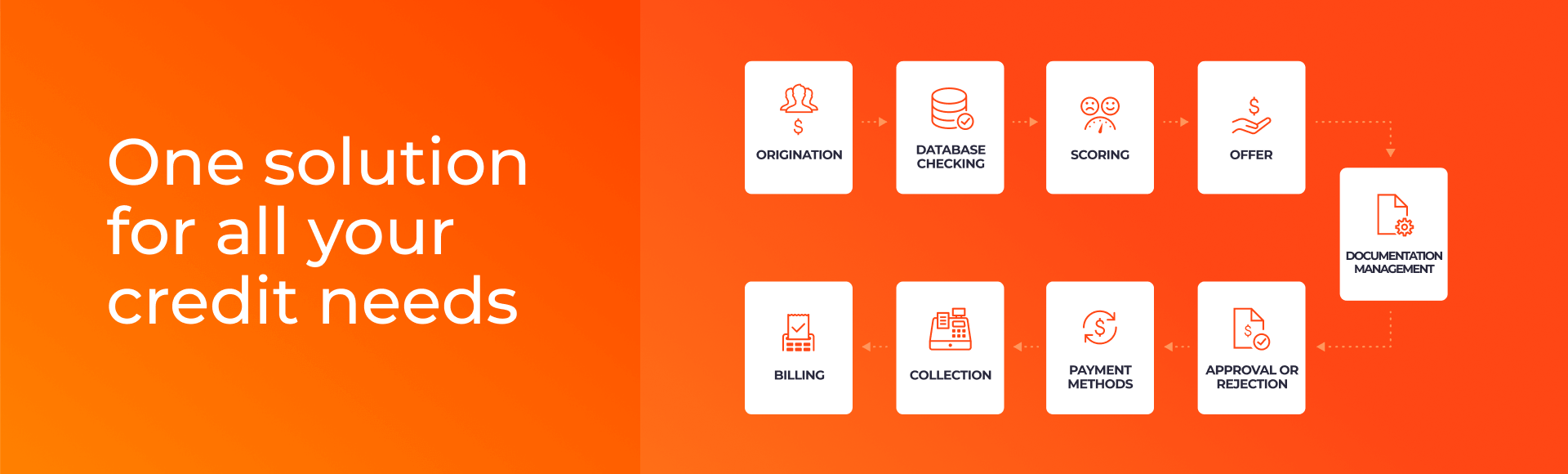

Efficient loan management

- Automated loan transaction management, reducing manual intervention and increasing transaction volume.

- Minimal implementation time, accelerating time to market.

- Cloud-based plug-and-play system, eliminating the need for installation.

- Modular design, allowing for customization and tailoring to meet specific needs.

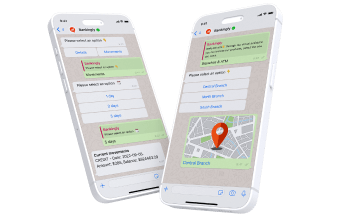

Streamlined collection management

Stay on top of payment commitments and efficiently manage your collections process with our automated payment reminders and early defaulter management through SMS and WhatsApp.

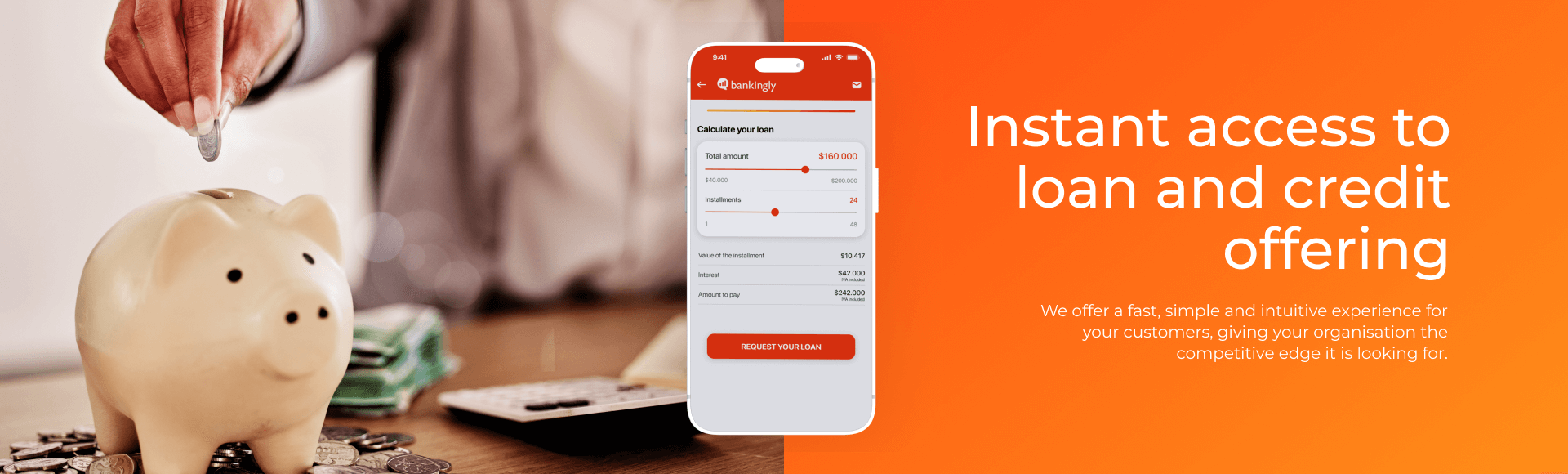

Shorter processing time for loan and credit scoring applications process.

Enhanced fraud detection and risk management through our machine learning algorithms.

Enable a quicker loan evaluation that boost satisfaction and steers longer-term relationships.

React instantly to changing industry policies and new regulations.

Enable 24/7 requests without the need for branches or service staff.

-

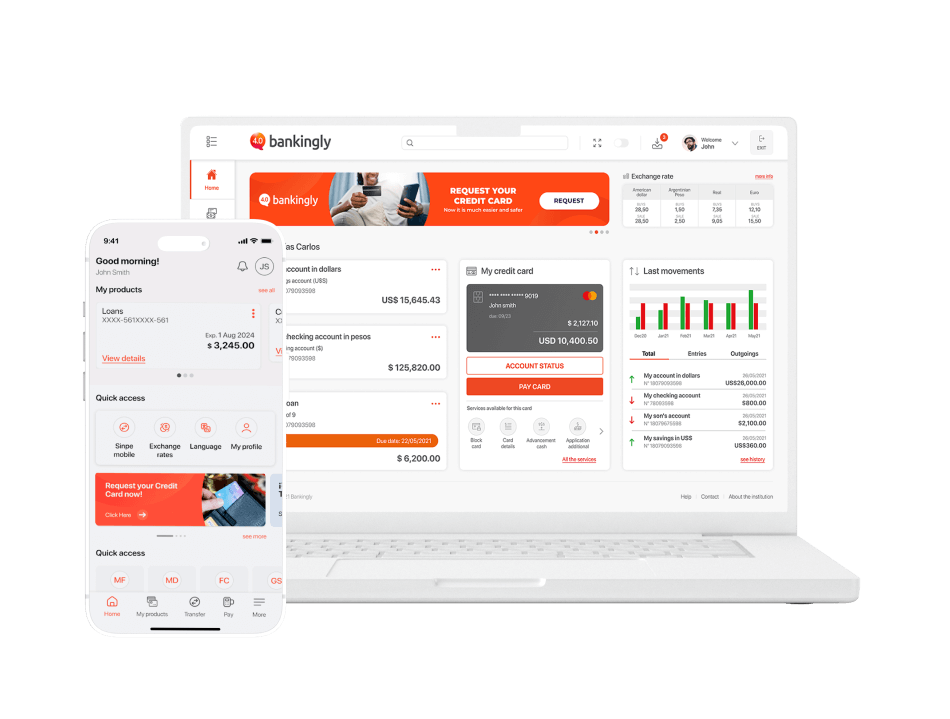

Mobile and Online Banking have been very well received by our partners, leaving us good feedback on the tools we have provided them to manage their accounts

Martín V. Chief Information Security Officer -

A great solution for our partners. We have received the necessary support and more from Bankingly, always maintaining full readiness to support us at any time. Excellent and very professional treatment

Joshue Fernando L. Operations Coordinator -

A great tool: practical, functional, and easy to use in all aspects, both for administration and for the general public

Francisco M. Systems Manager -

The experience is excellent: product centralization, ease of access, excellent visualization, effective administration changes and management, important updates. In addition to exceptional support

Zunilda G. Project and Innovation Specialist -

We implemented the self-management strategy for bank clients to easily access information and transactions. The integration was simple through parameterization and API integration

Edna Mabel R. Channels Director -

The agility in integration and implementation is remarkable. The SaaS platform facilitates the operation. From the beginning, the tool offers numerous options that allow offering online services competitively

Luis L. VP Digital Transformation & Technology -

The product is highly appreciated by our clients, as it allows them to self-manage in the most used transactions. It stands out for its potential, with a very reasonable cost-benefit ratio

Eric C. Chief of Digital Channels -

My experience is very good; I love the 'bank at hand' feature because I can easily see my products. The platform is user-friendly, with a simple registration and usage process

Rafael R. Communication Analyst

We have a way of getting you there

Frequently Asked Questions

Yes! Our Digital Onboarding solution includes an administration portal that allows financial institutions to manage and supervise the entire onboarding process efficiently.

Yes, you can offer all your credit products on the Digital Onboarding portal. The solution allows you to configure different workflows for each type of product, adapting the customer experience to their specific needs.

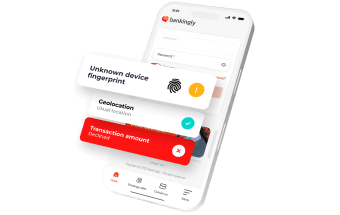

Yes! Our solution offers the possibility to validate the user's information with different methods, including:

- Legal identification processing: Verification of the user's identity through facial recognition and comparison with official documents.

- Photo/OCR capture: Extraction of data from the user's ID or passport through image capture and OCR technology.

- Biometrics: Validation of the user's identity through fingerprint or facial recognition.

- Liveness test: Verification that the user is a real person through a liveness test.

- Photo validation: Detection of whether the user's photo is real and has not been manipulated.

- Money laundering prevention verification: Screening of the user's information against lists of PEPs and other relevant databases.

- Validation of international lists: Verification of the user's information against international lists of sanctioned individuals and others.

- Option to define custom lists: Possibility to create custom lists for user validation according to the specific needs of the financial institution.

The information provided by the user is stored within the administration portal of the Onboarding solution itself. The information is protected by the highest security measures, including data encryption and security protocols.