Back to all solutions

Back to all solutions

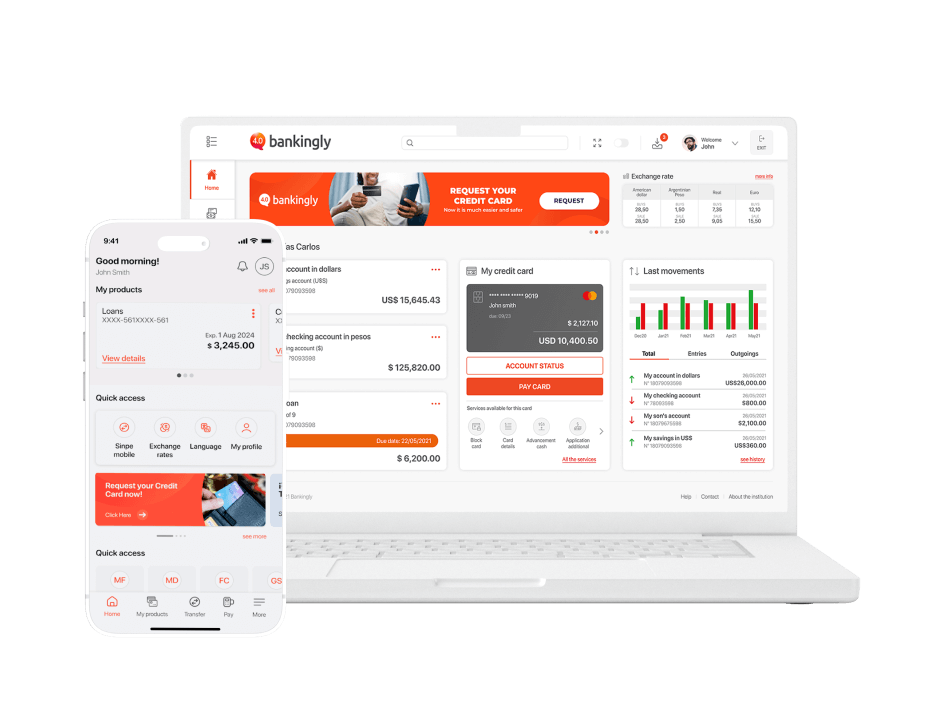

Web & mobile banking

Customers are moving to financial services that simplify their lives. Entities must adopt digitally enabled features that customers now believe as must-haves.

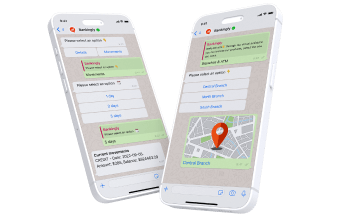

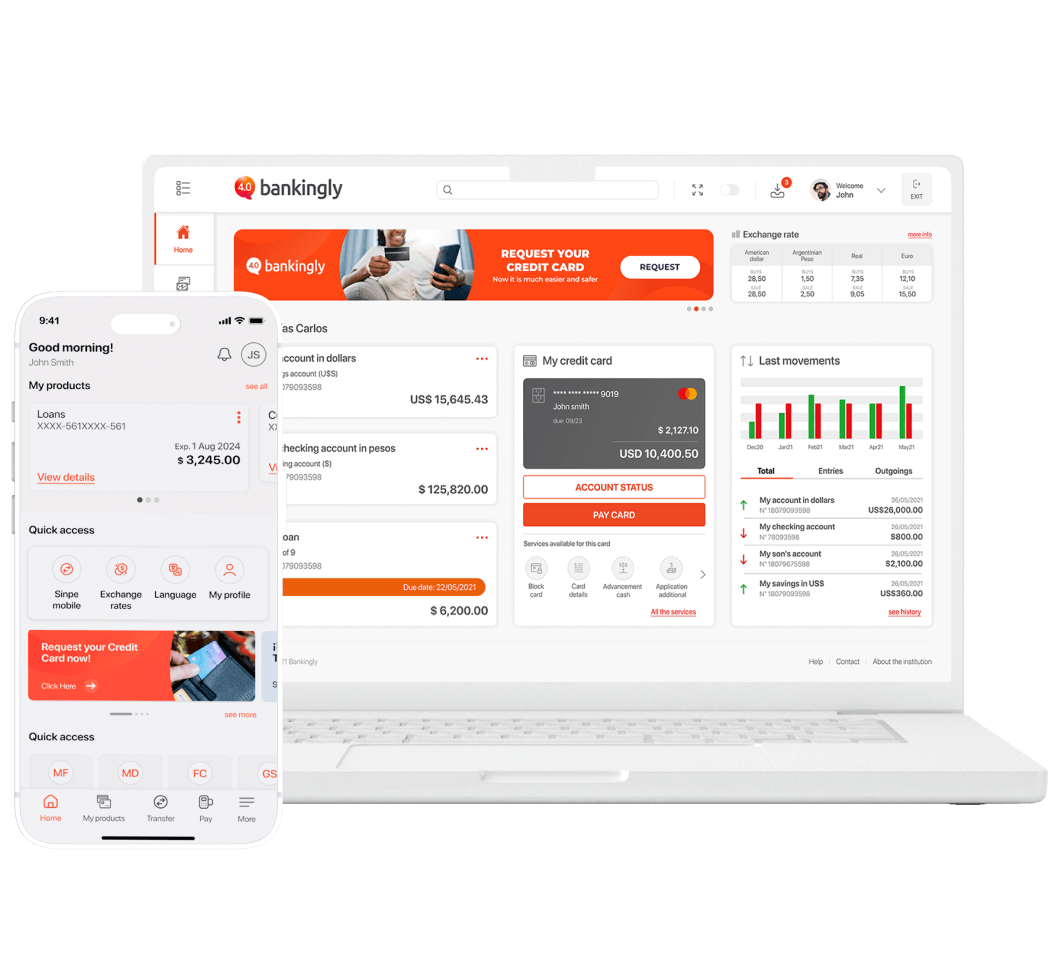

The next step is to create a branch on-the-go experience. Feel the full power of omnichannel banking through our cutting-edge and friendly solution. Your customers can access to key banking functions in a completely new way.

Anytime banking

Meet modern customer expectations through a convenient and secure 24x7 solution

4.6 average rating on Google Play, Apple and Huawei stores.

Platform designed and regularly updated to ensure compliance with local regulations.

World class solution with more than 3.5MM users in 23 countries.

Pay only for actual usage without upfront costs for licenses, infrastructure, staff, or support.

100% SaaS Solution. Operated on Microsoft Azure that guarantees safety and scalability.

Fast implementation and integration to CORE banking under 8 weeks.

Product upgrades included based on market needs.

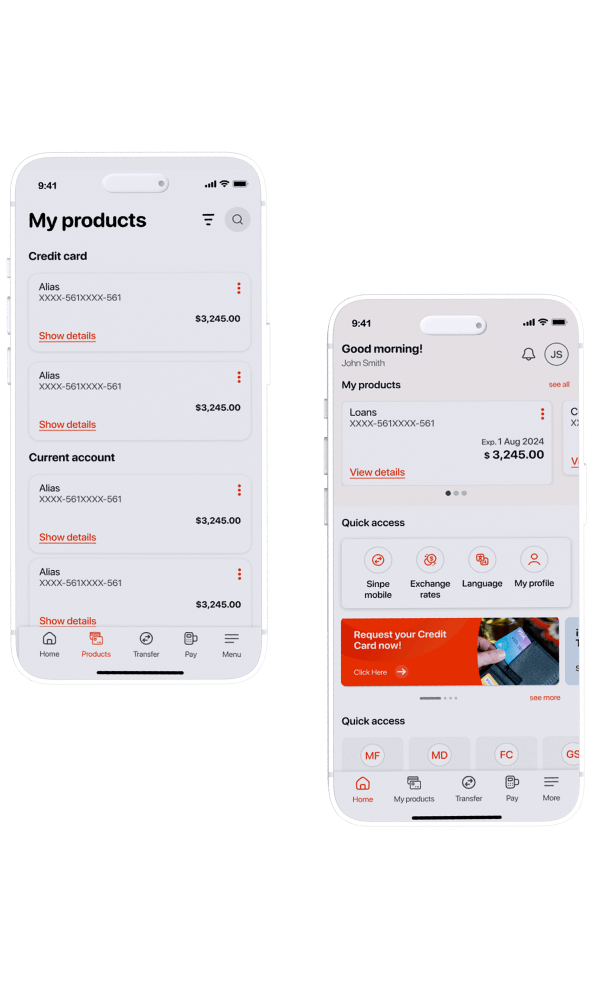

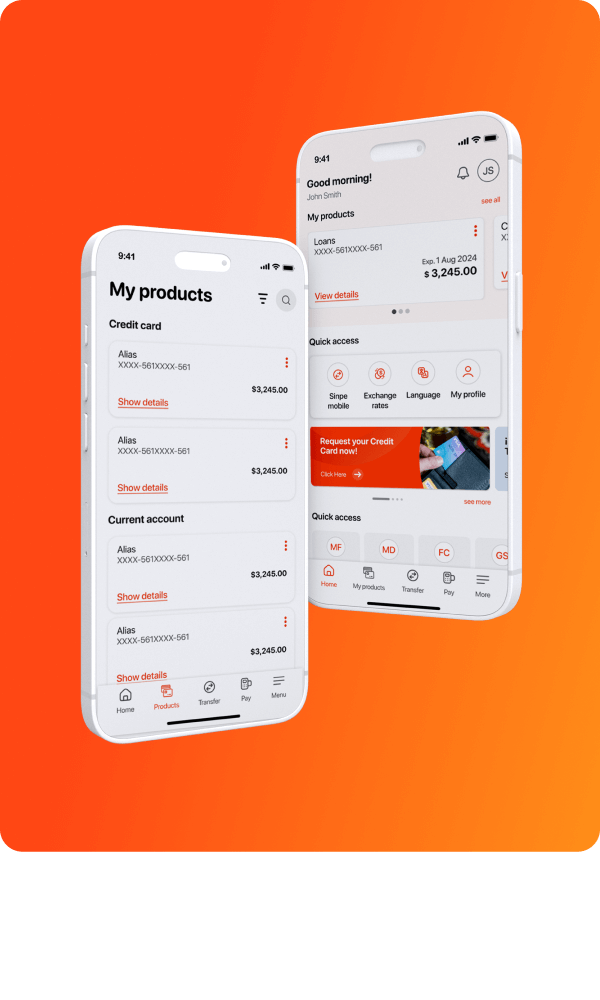

We provide a modern and integrated digital banking suite

- Digital banking features: account management, real-time transactions, loan and check management, credit cards, service payment, investments, fixed-terms deposit, credit lines

- Professional business banking module

- Wallet payments and transfers

- QR transactions supporting local country interoperability

- Communications module: WhatsApp, push notifications, e-mail, SMS campaigns, inbox

- Public area: news, benefits, branches, contact us

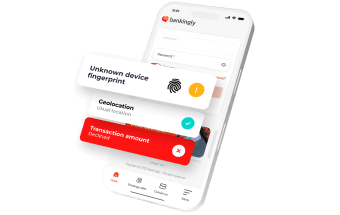

Are you looking for an advanced security platform?

Take advantage of our one-touch login using device biometrics, multi-factor authentication, end-to-end encryption, single session validation and user behavior analysis

-

Mobile and Online Banking have been very well received by our partners, leaving us good feedback on the tools we have provided them to manage their accounts

Martín V. Chief Information Security Officer -

The agility in integration and implementation is remarkable. The SaaS platform facilitates the operation. From the beginning, the tool offers numerous options that allow offering online services competitively

Luis L. VP Digital Transformation & Technology -

A great solution for our partners. We have received the necessary support and more from Bankingly, always maintaining full readiness to support us at any time. Excellent and very professional treatment

Joshue Fernando L. Coordinador de Operaciones -

A great tool: practical, functional, and easy to use in all aspects, both for administration and for the general public

Francisco M. Systems Manager -

We implemented the self-management strategy for bank clients to easily access information and transactions. The integration was simple through parameterization and API integration

Edna Mabel R. Channels Director -

The experience is excellent: product centralization, ease of access, excellent visualization, effective administration changes and management, important updates. In addition to exceptional support

Zunilda G. Project and Innovation Specialist -

The product is highly appreciated by our clients, as it allows them to self-manage in the most used transactions. It stands out for its potential, with a very reasonable cost-benefit ratio

Eric C. Chief of Digital Channels -

My experience is very good; I love the 'bank at hand' feature because I can easily see my products. The platform is user-friendly, with a simple registration and usage process

Rafael R. Communication Analyst

We have a way of getting you there

Frequently Asked Questions

Yes, Bankingly easily integrates with various financial CORE systems, ensuring an optimal user experience. Our technical team adapts to the needs of each institution.

Yes! Bankingly offers a wide range of standard functionalities. If you need additional functionalities, our development team can help you implement them with an additional cost, which will depend on the complexity of the functionality.

At Bankingly, we prioritize regulatory compliance for financial institutions. We support you throughout the regulatory process, from identifying applicable regulations to implementing the necessary measures to comply with them.

No! Bankingly's customer support is free of charge. We support you throughout the life cycle of the business relationship, from implementation to daily use of the platform.

Bankingly implements robust measures to protect information and ensure secure transactions. We use state-of-the-art encryption technologies and security protocols to protect your customers' information.