The Future of Banking: Predictions for the Next Decade

This article will explore emerging banking trends and offer predictions for the next decade's financial landscape.

Over the past ten years, the banking sector has experienced unprecedented transformation.

A decade ago, the idea of completing all your banking tasks without setting foot inside a bank would have been met with laughter. But as technology has advanced, so has the realm of digital banking, reshaping our expectations and experiences.

As we stand at this juncture, it's essential to look ahead and contemplate the future trajectories of this industry, so that we can be prepared for what is ahead.

So let's look ahead, explore the evolving trends, and make some predictions that might define banking in the next decade.

1. The Meteoric Rise of Mobile Money

One thing's for certain: mobile money is not just a fad. It's an unstoppable force. As per the GSMA report, digital transactions have seen a whopping increase.

The reliance on cash is waning, with transaction values catapulting by 22% between 2021 and 2022, from $1 trillion to a staggering $1.26 trillion.

With seamless online transactions, intuitive user interfaces, and round-the-clock accessibility, it's no wonder that digital banking platforms, such as those offered by Bankingly, are pivotal.

They're not just enhancing user experience; they're redefining it. Expect this trajectory to continue as mobile money services reach even the remotest corners of the globe.

2. Safety First: Fraud Prevention and Enhanced Security

As the digital realm grows year after year, so do potential vulnerabilities. This will be a significant point of focus in the coming years.

The traditional username-password model, while foundational, no longer suffices.

Banks and financial platforms like Bankingly are already trying to get ahead of this issue by adopting multi-layered security protocols.

This involves a combination of something the user knows (passwords or PINs), something the user has (smartcards or authentication apps), and something the user is (biometrics).

The next decade will likely witness financial institutions doubling down on security in the following ways:

- Biometric Verification: Facial recognition, fingerprint scans, and even voice prints are making waves in the financial sector.

- Mandatory Two-factor Authentication (2FA): 2FA will transition from being an optional security measure to a mandatory one.

- End-to-End Encryption: End-to-end encryption ensures that data, whether it's personal details or transactional information, is rendered unreadable to anyone except the intended recipient.

- Proactive Monitoring and Artificial Intelligence: Bankingly, among other frontrunners in the financial space, is leveraging AI to monitor transaction patterns. Any anomalies or suspicious activities are flagged in real time, allowing for immediate action.

3. Deciphering Patterns: The Role of Data Analytics

Knowledge is power, and in the banking sector, this knowledge is derived from data.

Advanced data analytics tools are already enabling institutions to gain profound insights into customer behavior, market trends, and potential risks. In the future, the amount of data available and its uses will be beyond our imagination right now.

Expect banks to utilize these analytics to create hyper-personalized banking experiences, predict market shifts, and even preempt potential financial threats.

As the next decade unfolds, innovation will be pivotal. But not just any innovation—strategic, data-driven initiatives that address genuine market gaps.

Banks, armed with insights, will venture into uncharted territories, creating novel banking paradigms and setting benchmarks for the industry.

4. Conversational Banking will Come of Age

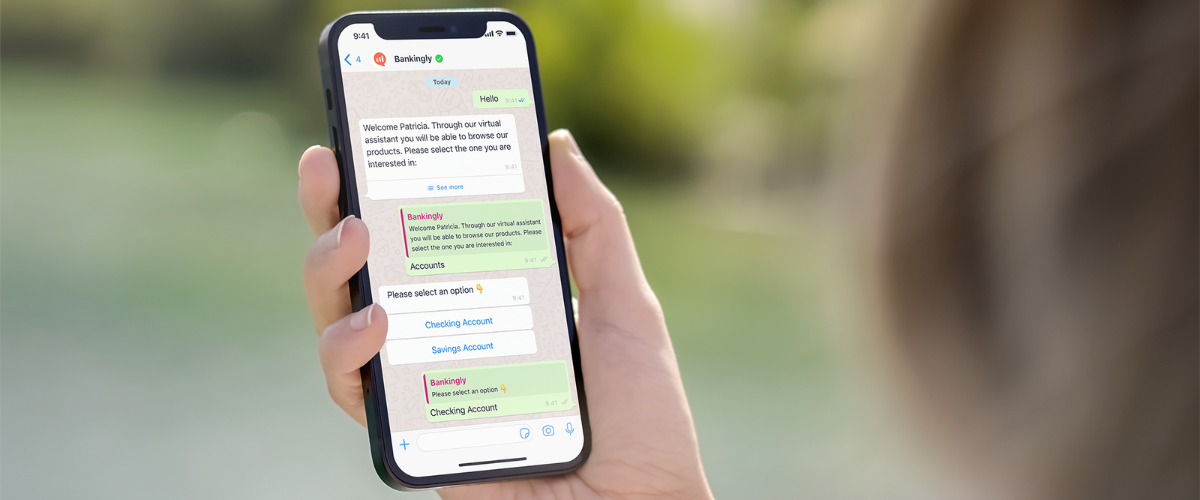

In the next decade, another major shift will be conversational interfaces, like the ones provided by Bankingly.

These will redefine customer service.

Rather than navigating through apps or websites, users will interact with chatbots or voice assistants for their banking needs, making the experience more intuitive and user-friendly.

What exactly makes them such a game-changer?

- Real-time Responses

- 24/7 Availability

- Simplified Experience

- Personalized Interactions

5. A Green Transition with Sustainable Banking

As the world grapples with escalating environmental challenges, the banking sector is poised to play a pivotal role in crafting a sustainable future.

The next decade promises a transition where banks evolve beyond their traditional roles as mere financial intermediaries. Instead, they will emerge as vanguards of socio-environmental responsibility, leading the charge toward a greener and more conscientious economic landscape.

Here's what to expect:

- Eco-conscious Product Offering

- Carbon Neutrality Commitment

- Digital Tools for Eco-awareness

- Impact Investing

- Eco-Incentives

Diversifying for a Robust Financial Future

The upcoming decade promises an exhilarating evolution for the banking sector.

While digital banking remains the backbone, complementary technologies like security protocols, data analytics, and AI are rising in prominence.

With platforms like Bankingly, which encapsulate these offerings under one roof, financial institutions can be well-equipped to navigate the challenges and opportunities of the future.

Dive deep into the future of diversified banking. Embrace the revolution with Bankingly!

Back

Backto top